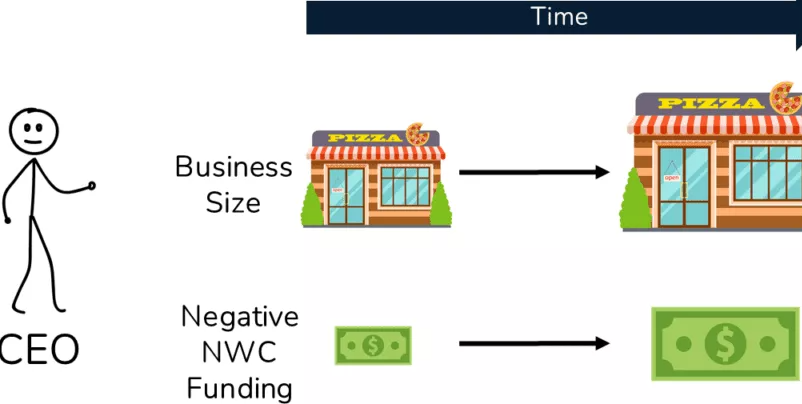

A company can have negative working capital if its current assets are less than its current liabilities. The difference between a company's existing assets and current liabilities is known as its "working capital." Either the company's current assets fall because of large, unexpected cash outlays, or the company's current liabilities grow because of sharp growth in accounts payable due to expanding credit.

Cash and Other Liquid Assets, Explained

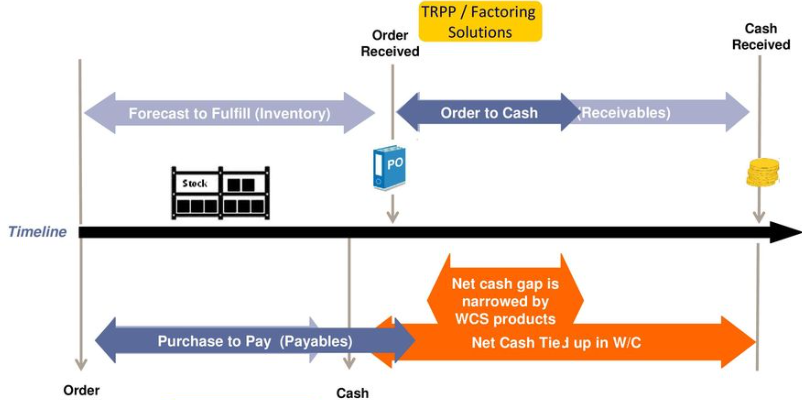

Limitations in working capital can hurt a company's bottom line in general and its ability to make long-term investments and meet short-term obligations. Working capital refers to a company's liquid assets that can be utilized to meet its immediate financial obligations and other short-term business needs.

A portion of a business's working capital should be allocated toward paying bills in advance. When calculating a company's value, some investors don't include short-term assets like cash and cash equivalents, as well as long-term liabilities like loans and debt payments due within a year from working capital.

To calculate working capital, one must add up the net amount of current assets. However, this number need not be positive. Negative or zero values are possible. For this reason, the impact of working capital on a company's bottom line might vary depending on the amount available.

Working capital measures a company's ability to meet its short-term financial commitments.

Cash Flow That Turns a Profit

When a company has current assets more significant than its current liabilities, it has positive working capital. If a company has sufficient working capital, it can pay off its short-term debts when they come due within a year. This is a sign of the company's stable financial situation.

If a business has valuable assets sitting in inventory that aren't moving or accounts receivable that aren't getting paid, the company isn't using those assets properly.

Money that can be invested long-term, like that currently languishing in accounts receivable and inventory, should be used for investments that provide a better return. Therefore, keeping a level of working capital that gives the company adequate financial strength while still allowing for reasonable investment returns is essential. Between 20% and 100% is a typical range for working capital as a proportion of current liabilities that effectively achieve this aim.

Inadequate Capital on Hand

When a company's current assets are equal to its current liabilities, there is no working capital. The condition is satisfied if a company's existing assets are similar to its current liabilities. Having no working capital or taking any long-term money for short-term uses is loaded with severe hazards to a company's financial health, even though doing so increases investment efficiency.

Short-term assets, such as stockpiles of perishable goods, can impede the speed with which debts can be settled. The ability of a business to meet its debt obligations on time is contingent on the level of its current assets.

Non-Physical Resources

Working capital refers to the surplus or deficit between a company's current assets and obligations. Working capital is negative when current liabilities outweigh existing assets. Negative working capital occurs when either current assets are lowered by a large cash payment or accounts payable are increased by an equivalent amount.

Generally, a corporation has positive working capital when its current assets are more than its current liabilities and negative working capital when the two are equal.

Inadequate Working Capital on the Horizon

Poor working capital is strongly connected with a negative current ratio, calculated by dividing a company's existing assets by its current liabilities. To have negative working capital, the current balance needs to be less than 1. As a result, short-term debts are more significant than short-term assets.

An unexpectedly substantial cash outlay or an increase in accounts payable due to an out-of-the-ordinary volume of supplier purchases are the most common short-term causes of a negative working capital position.

Concerns arise when a company's working capital is negative for an extended period. This may indicate that the business is struggling to make ends meet and will likely need to raise funds through further debt or a stock offering to cover its daily operating expenses.

The amount of a company's working capital varies depending on the state of the economy. Therefore, working capital can be utilized as a measure of corporate effectiveness. An operating capital surplus could indicate that a corporation is unduly careful with its financial management. However, if the company is short on working capital, it likely takes unnecessary financial risks to fund its day-to-day operations.

Your One-Stop Shop for All Your Online Needs

It's considerably more straightforward than you think to gain access to numerous DeFi platforms covering everything from cryptocurrency to NFTs. OKX is a trusted platform for buying, selling, and storing digital assets. Link your existing wallets and be entered to win up to $10,000 if you deposit at least $50 in crypto via purchase or top-up within 30 days of signing up. Learn more and sign up immediately!