Self-employed people, freelancers, and those with substantial extra-work income are obliged to file and pay quarterly taxes. Estimated tax payments, made quarterly throughout the year, can help taxpayers meet their annual tax obligations and avoid interest and penalties. Complete Form 1040-ES, Estimated Tax for Individuals, to calculate your estimated tax liability for the quarter and submit it with your quarterly tax payment. The income, deductions, and credits you claim on this form will be used to determine your tax liability. After calculating the total, you can submit payment electronically through the Electronic Federal Tax Payment System (EFTPS), mail, or direct debit. Taxes must be paid on or before the April 15, June 15, September 15, and January 15 quarterly deadlines.

Getting Quarterly Taxes Right

Self-employed people, independent contractors, and those with significant investment income are among those who must make quarterly tax payments since their taxes are not automatically withdrawn from their paychecks. You can spread out the cost of your annual tax bill by making quarterly installments instead.

How to Estimate Your Tax Bill

Estimating your tax liability for each quarter before you can pay your taxes on time would be best. Form 1040-ES, the Individual's Estimated Tax Return, is the most widely used method. The income, deductions, and credits you claim on this form will be used to determine your tax liability. Use tax software or visit a tax expert for precise numbers.

Obtaining the Required Information

Compile your income records, expenses, deductions, and credits before completing Form 1040-ES. It's essential to keep tabs on your income and spending throughout the year so that you can calculate your tax bill with precision.

Completing Form 1040-ES

Your estimated income, deductions, credits, and tax liability must all be entered into separate sections of Form 1040-ES. Please take your time and double-check your answers as you go along. To help you fill out the form correctly, we've included instructions.

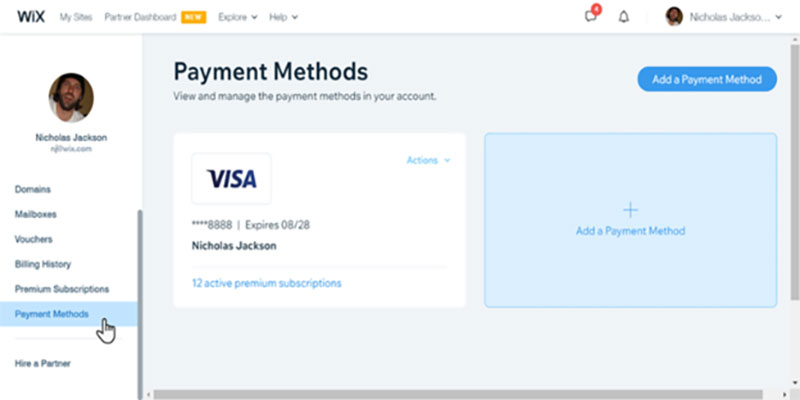

Choosing a Method of Payment

After determining your tax burden, you must select a payment option. Among the many choices offered by the IRS are the following:

- You can safely and conveniently pay your federal taxes online through the Electronic Federal Tax Payment System (EFTPS). To make use of this service, you must first register for it.

- Payment by Direct Debit is an option for those who e-file their tax returns. On the due date, the IRS will automatically deduct the amount from your specified bank account.

- Form 1040-ES can also be mailed to the address listed on the form, together with a cheque or money order. Be sure that your payment reaches the IRS on time so that you can avoid late fees.

- Timeliness of Payments

Four times a year, on the following dates, tax payments are due:

- First quarter (from January 1 to March 31), payments are due on April 15.

- Prices for the second quarter (April 1 - May 31) are due June 15.

- Third quarter (June 1 - August 31) payments are due September 15.

- The price for the fourth quarter (October 1 through December 31) is expected on January 15.

- Be sure to put these dates in your calendar and make timely payments to prevent late fees and interest.

Keeping Correct Records

When filing quarterly taxes, it is essential to keep detailed records. Keep duplicates of Form 1040-ES submission confirmations, payment receipts, and other pertinent financial documents. Having these documents on hand will be extremely helpful come tax time or if you are audited.

Adjusting Your Payments

It is essential to reassess your expected tax payments if there is a change in your income or financial status. Adjust your expected tax payments if you wish a change in income, either up or down. If you don't make the necessary changes to your expenses, you could find yourself with underpayment penalties or an enormous tax bill at year's end. Estimated tax payments can help you comply with your tax responsibilities if you evaluate and revise them regularly.

Seek Advice from a Professional

Predicting and paying quarterly taxes can be daunting, especially if your financial situation is complex. If you need help understanding and making your quarterly tax payments, see a tax professional such as a certified public accountant (CPA) or an enrolled agent.

Conclusion

Self-employed people, freelancers, and those with significant extra-work income are obliged to file and pay quarterly taxes. This tutorial will help you quickly make quarterly tax payments by explaining the procedure and outlining the actions you need to take. Make an accurate tax bill calculation, select the most convenient payment option, and submit your return on time to avoid incurring penalties and interest. Estimated tax payments should be reviewed and revised regularly. If you need help handling your taxes, getting advice from an expert is best.